In some cases, part or all of the expense accounts simply are listed in alphabetical order. For example, sales would be listed before non-operating income. Revenue and expense accounts tend to follow the standard of first listing the items most closely related to the operations of the business. Account Orderīalance sheet accounts tend to follow a standard that lists the most liquid assets first. If the business has more than one checking account, for example, the chart of accounts might include an account for each of them.

Other accounts should be set up according to vendor. One should check the appropriate tax regulations and generate a complete list of such required accounts. the IRS requires that travel, entertainment, advertising, and several other expenses be tracked in individual accounts. Some accounts must be included due to tax reporting requirements. In this respect, there is an advantage in organizing the chart of accounts with a higher initial level of detail. For example, if the accounting system is set up with a miscellaneous expense account that later is broken into more detailed accounts, it then would be difficult to compare those detailed expenses with past expenses of the same type. However, following this strategy makes it more difficult to generate consistent historical comparisons. Starting with a small number of accounts, as certain accounts acquired significant balances they would be split into smaller, more specific accounts. Initially keeping the number of accounts to a minimum has the advantage of making the accounting system simple. There is a trade-off between simplicity and the ability to make historical comparisons.

Finale inventory find account name software#

Accounting software packages often come with a selection of predefined account charts for various types of businesses.

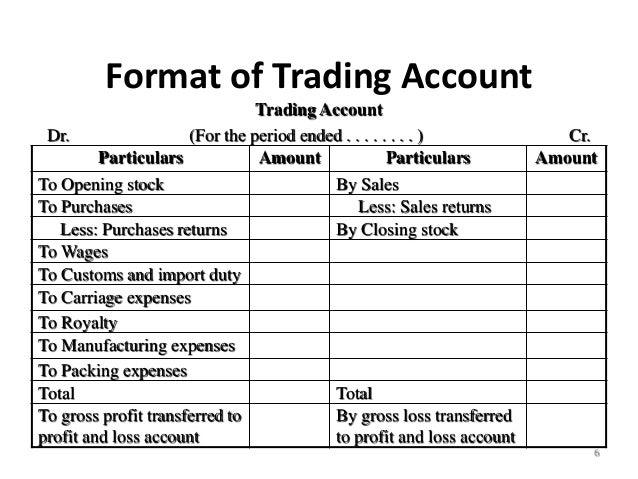

Many industry associations publish recommended charts of accounts for their respective industries in order to establish a consistent standard of comparison among firms in their industry. For example, to report the cost of goods sold a manufacturing business will have accounts for its various manufacturing costs whereas a retailer will have accounts for the purchase of its stock merchandise.

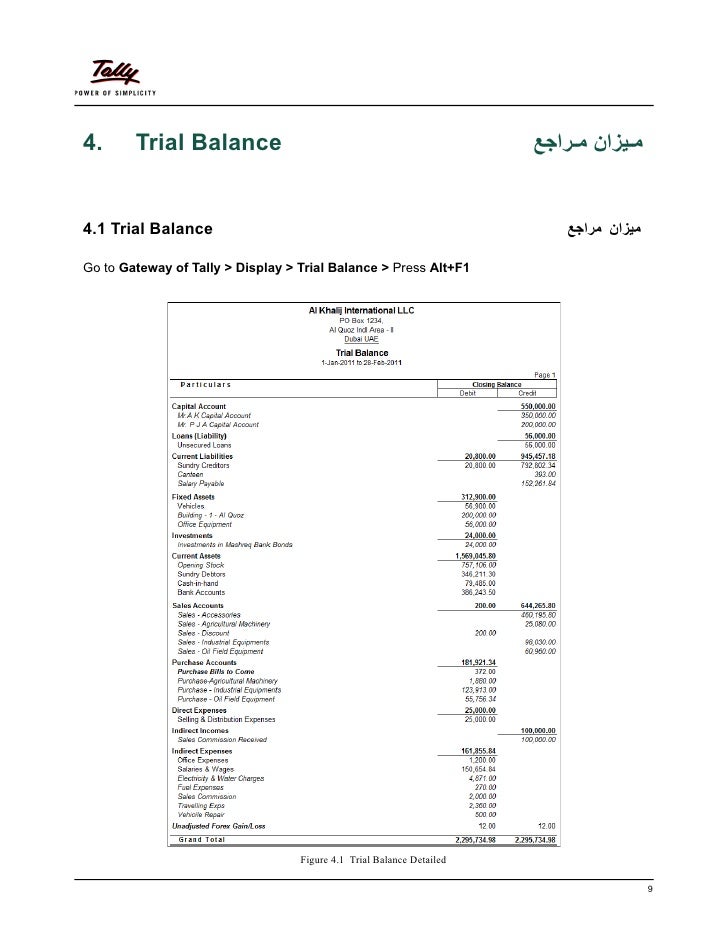

Defining Accountsĭifferent types of businesses will have different accounts. An example of how the digits might be coded is shown in this list: Account Numberingħ000 - 7999: other revenue (for example, interest income)Ĩ000 - 8999: other expense (for example, income taxes)īy separating each account by several numbers, many new accounts can be added between any two while maintaining the logical order. It is worthwhile to put thought into assigning the account numbers in a logical way, and to follow any specific industry standards. Complex businesses may have thousands of accounts and require longer account reference numbers. With more digits, new accounts can be added while maintaining the logical order. For very small businesses, three digits may suffice for the account number, though more digits are highly desirable in order to allow for new accounts to be added as the business grows. Each account should have a number to identify it. To set up a chart of accounts, one first needs to define the various accounts to be used by the business. The chart of accounts is a listing of all the accounts in the general ledger, each account accompanied by a reference number. Accounting > Chart of Accounts Chart of Accounts

0 kommentar(er)

0 kommentar(er)